Page 5 of 10

Re: Investment advice

Posted: Thu Jan 28, 2021 8:20 am

by tennbengal

Still no idea why the idea of shorting is even allowed but thrilled to see it used to fuck over hedge bros.

Re: Investment advice

Posted: Thu Jan 28, 2021 8:25 am

by Johnnie

It's a counterbalance to a company pumping their worth.

The problem isn't shorting, it's allowing this much shorting.

Also:

The premarket is showing $500 spikes and every damn outlet is trying to smear Redditors.

Re: Investment advice

Posted: Thu Jan 28, 2021 8:25 am

by Rex

I’m kind of excited for when these liberators are profiled in feature articles and we all find out that they’re all MAGA as hell

Re: Investment advice

Posted: Thu Jan 28, 2021 8:30 am

by Johnnie

It's looking like once the market opens at 0930 everyone is going to get in on the action. The story is international at this point and people want to ride along for the 'fuck you' of it all.

Re: Investment advice

Posted: Thu Jan 28, 2021 8:45 am

by A_B

Re: Investment advice

Posted: Thu Jan 28, 2021 9:07 am

by Johnnie

Hmm, the stock dipped and according to the internets Robin Hood isn't allowing anyone to buy the stock at all.

Re: Investment advice

Posted: Thu Jan 28, 2021 9:09 am

by Johnnie

Re: Investment advice

Posted: Thu Jan 28, 2021 9:11 am

by A_B

Johnnie wrote: ↑Thu Jan 28, 2021 9:07 am

Hmm, the stock dipped and according to the internets Robin Hood isn't allowing anyone to buy the stock at all.

Oh the irony.

Re: Investment advice

Posted: Thu Jan 28, 2021 9:26 am

by Gunpowder

A_B wrote: ↑Thu Jan 28, 2021 9:11 am

Johnnie wrote: ↑Thu Jan 28, 2021 9:07 am

Hmm, the stock dipped and according to the internets Robin Hood isn't allowing anyone to buy the stock at all.

Oh the irony.

Especially since if I want to buy a stock, I presumably have the money to cover it, unlike the shorters. Robinhood gonna go under after this

Re: Investment advice

Posted: Thu Jan 28, 2021 9:27 am

by Gunpowder

GME was at damn near 500 an hour ago. Now it's at 280.

Re: Investment advice

Posted: Thu Jan 28, 2021 9:33 am

by Gunpowder

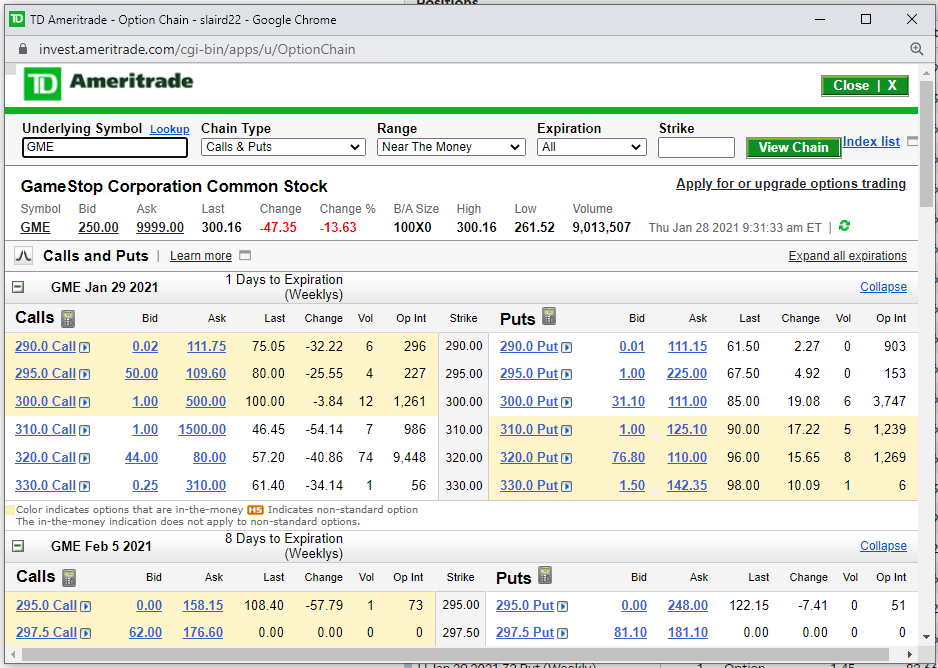

What even is this

- wtf.png (74.98 KiB) Viewed 671 times

Re: Investment advice

Posted: Thu Jan 28, 2021 9:33 am

by brian

Isn't Occam's Razor here that these are just bunches of people "selling high"? It's not like the play was going to be to ride the stock until Game Stop is the only stock for sale in the world.

Re: Investment advice

Posted: Thu Jan 28, 2021 9:34 am

by Gunpowder

brian wrote: ↑Thu Jan 28, 2021 9:33 am

Isn't Occam's Razor here that these are just bunches of people "selling high"? It's not like the play was going to be to ride the stock until Game Stop is the only stock for sale in the world.

There's likely a large component of that but a lot of this stuff happens during after and pre-market times which is basically manipulation in itself. Regular people selling high probably aren't going to buy at night and then sell at 8:47am.

Re: Investment advice

Posted: Thu Jan 28, 2021 9:43 am

by mister d

Am I wrong thinking its outsiders who want to join in that'll be holding the bag whenever a majority of (whatever the reddit group is called) decides to bail? Like this whole transfer of wealth only really occurs when the people who drove the spike have cashed out.

Re: Investment advice

Posted: Thu Jan 28, 2021 9:46 am

by Gunpowder

mister d wrote: ↑Thu Jan 28, 2021 9:43 am

Am I wrong thinking its outsiders who want to join in that'll be holding the bag whenever a majority of (whatever the reddit group is called) decides to bail? Like this whole transfer of wealth only really occurs when the people who drove the spike have cashed out.

Nope - some people are going to lose all of these gains. If I had gotten in early enough I probably would have hedged by now.

The transfer will only happen if and when hedge funds close positions or go bankrupt.

Re: Investment advice

Posted: Thu Jan 28, 2021 9:55 am

by govmentchedda

Gunpowder wrote: ↑Thu Jan 28, 2021 9:46 am

mister d wrote: ↑Thu Jan 28, 2021 9:43 am

Am I wrong thinking its outsiders who want to join in that'll be holding the bag whenever a majority of (whatever the reddit group is called) decides to bail? Like this whole transfer of wealth only really occurs when the people who drove the spike have cashed out.

Nope - some people are going to lose all of these gains. If I had gotten in early enough I probably would have hedged by now.

The transfer will only happen if and when hedge funds close positions or go bankrupt.

Yeah, hedge funds have to love the press on this. Get more joes in for a supposed quick rise, who sell quick.

Re: Investment advice

Posted: Thu Jan 28, 2021 10:25 am

by Brontoburglar

robinhood was a tad shady to begin with and this feels like its great undoing

Re: Investment advice

Posted: Thu Jan 28, 2021 10:48 am

by The Sybian

This has been a fascinating education for me. I didn't realize until today that I didn't fully understand what it meant to short a stock. It seems insane that it's allowed, but I guess the investor class control the law makers, so the game is always skewed in their favor. The conversation with the Indian guy and the TV guy was fascinating. I think the TV guy really believes what he is saying, but is willfully blind to the fact that the investment banks/funds play the same dirty game, but in his mind, they are justified, because they are inside the system. It was interesting how he tried to justify to himself that he was looking out to protect the little guys because they will get hurt, when in reality, it's the bankers/fund guys fucking over the rest of us for the benefit of their wealthy investors and themselves.

So I now understand how shorting works, can someone explain how it benefits brokers? I assume they get commissions on putting through trades, but don't they lose money in the transaction? Using the numbers in the Jim Kelly Tweet, if the broker lends me a stock at $10, then I buy it at $7 and give it to him, isn't he out $3? I'm sure that isn't the case, because they wouldn't do that. It's just amazing how much wealth is created out of nothing by these "creative" ways to manipulate the system.

Re: Investment advice

Posted: Thu Jan 28, 2021 10:48 am

by Nonlinear FC

Re: Investment advice

Posted: Thu Jan 28, 2021 10:51 am

by A_B

The Sybian wrote: ↑Thu Jan 28, 2021 10:48 am

This has been a fascinating education for me. I didn't realize until today that I didn't fully understand what it meant to short a stock. It seems insane that it's allowed, but I guess the investor class control the law makers, so the game is always skewed in their favor. The conversation with the Indian guy and the TV guy was fascinating. I think the TV guy really believes what he is saying, but is willfully blind to the fact that the investment banks/funds play the same dirty game, but in his mind, they are justified, because they are inside the system. It was interesting how he tried to justify to himself that he was looking out to protect the little guys because they will get hurt, when in reality, it's the bankers/fund guys fucking over the rest of us for the benefit of their wealthy investors and themselves.

So I now understand how shorting works, can someone explain how it benefits brokers? I assume they get commissions on putting through trades, but don't they lose money in the transaction? Using the numbers in the Jim Kelly Tweet,

if the broker lends me a stock at $10, then I buy it at $7 and give it to him, isn't he out $3? I'm sure that isn't the case, because they wouldn't do that. It's just amazing how much wealth is created out of nothing by these "creative" ways to manipulate the system.

It's not the broker that gets screwed, it's someone else that had to sell at $7 after you shorted it at $10 and the price dropped. You took $3 from the market and the stock holder whose you "borrowed" is the one that loses the $3. The broker just handles the transactions.

ETA: I suppose the brokerage firm can have a position that would cause them to lose, but generally speaking they should be smart enough to get out before the price drops to massive losses.

Re: Investment advice

Posted: Thu Jan 28, 2021 10:52 am

by tennbengal

Re: Investment advice

Posted: Thu Jan 28, 2021 10:52 am

by mister d

The Sybian wrote: ↑Thu Jan 28, 2021 10:48 amThis has been a fascinating education for me. I didn't realize until today that I didn't fully understand what it meant to short a stock.

I've had the same discussion with a friend who works for a hedge fund. Its basically like how lawyers will aggressively defend people they know are pedophiles because "everyone deserves representation"; hedge funders believe anything they do in the market is ok because their tunnel-visioned role is client wealth and nothing else. Any personal ethical dilemmas can be boxed up and ignored.

Re: Investment advice

Posted: Thu Jan 28, 2021 10:55 am

by The Sybian

mister d wrote: ↑Thu Jan 28, 2021 10:52 am

The Sybian wrote: ↑Thu Jan 28, 2021 10:48 amThis has been a fascinating education for me. I didn't realize until today that I didn't fully understand what it meant to short a stock.

I've had the same discussion with a friend who works for a hedge fund. Its basically like how lawyers will aggressively defend people they know are pedophiles because "everyone deserves representation"; hedge funders believe anything they do in the market is ok because their tunnel-visioned role is client wealth and nothing else. Any personal ethical dilemmas can be boxed up and ignored.

If only I were a sociopath, I'd be a very wealthy man.

Re: Investment advice

Posted: Thu Jan 28, 2021 10:55 am

by mister d

A_B wrote: ↑Thu Jan 28, 2021 10:51 am

The Sybian wrote: ↑Thu Jan 28, 2021 10:48 amUsing the numbers in the Jim Kelly Tweet,

if the broker lends me a stock at $10, then I buy it at $7 and give it to him, isn't he out $3? I'm sure that isn't the case, because they wouldn't do that. It's just amazing how much wealth is created out of nothing by these "creative" ways to manipulate the system.

It's not the broker that gets screwed, it's someone else that had to sell at $7 after you shorted it at $10 and the price dropped. You took $3 from the market and the stock holder whose you "borrowed" is the one that loses the $3. The broker just handles the transactions.

No, the short-er is out.

A = Borrowee

B = Shorter

A sells at $10 at your direction and now

B is responsible to buy back at $13. The $3 gain goes to whoever you're buying the make-whole stock from.

Re: Investment advice

Posted: Thu Jan 28, 2021 10:57 am

by A_B

mister d wrote: ↑Thu Jan 28, 2021 10:55 am

A_B wrote: ↑Thu Jan 28, 2021 10:51 am

The Sybian wrote: ↑Thu Jan 28, 2021 10:48 amUsing the numbers in the Jim Kelly Tweet,

if the broker lends me a stock at $10, then I buy it at $7 and give it to him, isn't he out $3? I'm sure that isn't the case, because they wouldn't do that. It's just amazing how much wealth is created out of nothing by these "creative" ways to manipulate the system.

It's not the broker that gets screwed, it's someone else that had to sell at $7 after you shorted it at $10 and the price dropped. You took $3 from the market and the stock holder whose you "borrowed" is the one that loses the $3. The broker just handles the transactions.

No, the short-er is out.

A = Borrowee

B = Shorter

A sells at $10 at your direction and now

B is responsible to buy back at $13. The $3 gain goes to whoever you're buying the make-whole stock from.

Yes, if the price goes up, the shorter is out (which is this whole things that's happening). But his scenario was price going down as a shorter.

Re: Investment advice

Posted: Thu Jan 28, 2021 11:08 am

by Rex

I remember back when short selling was viewed as healthy market activity and, if anything, anti-establishment because it is a check on corporate management. That was like four days ago!

Re: Investment advice

Posted: Thu Jan 28, 2021 11:11 am

by A_B

Also, when selling on margin, don't you have to have an account set up to cover at least some (if not all, I can't remember the exact working of margin trading accounts) of the potential losses if the short sell doesn't work they way you were betting? I don't think most day traders have the liquidity to really do a bunch of short selling that would affect the market.

Re: Investment advice

Posted: Thu Jan 28, 2021 11:14 am

by Gunpowder

A_B wrote: ↑Thu Jan 28, 2021 11:11 am

Also, when selling on margin, don't you have to have an account set up to cover at least some (if not all, I can't remember the exact working of margin trading accounts) of the potential losses if the short sell doesn't work they way you were betting? I don't think most day traders have the liquidity to really do a bunch of short selling that would affect the market.

As a regular person, yes you need a certain amount of liquidity. I've been margin called and they give me a day to add money or sell off some other holdings to cover it. Or to close out my posish.

Re: Investment advice

Posted: Thu Jan 28, 2021 11:14 am

by P.D.X.

Struggling with how one stock could cause so much disruption. Like, there was just a massive amounts of money in the short position? From all across the hedge fund market? In f'ing Gamespot? And individual funds are so invested in that short position that this one stock could ruin them?

Re: Investment advice

Posted: Thu Jan 28, 2021 11:18 am

by Gunpowder

140% of the available shares were shorted

Re: Investment advice

Posted: Thu Jan 28, 2021 11:21 am

by mister d

P.D.X. wrote: ↑Thu Jan 28, 2021 11:14 am

Struggling with how one stock could cause so much disruption. Like, there was just a massive amounts of money in the short position? From all across the hedge fund market? In f'ing Gamespot? And individual funds are so invested in that short position that this one stock could ruin them?

Someone smarter correct me, but I think it’s because there’s no cap on losses the wrong way? If you’re at $10 and the stock shoots to $40, you’re 3x fucked.

Re: Investment advice

Posted: Thu Jan 28, 2021 11:23 am

by Rex

Yeah I think those are all factors. Small company which makes it volatile to begin with. Ridiculous short position, and when a short squeeze happens your loss is theoretically unlimited.

Re: Investment advice

Posted: Thu Jan 28, 2021 11:54 am

by DSafetyGuy

I'm just enjoying the concept of the wheels of capitalism being greased by the blood of the wealthy for once.

Re: Investment advice

Posted: Thu Jan 28, 2021 12:03 pm

by sancarlos

DSafetyGuy wrote: ↑Thu Jan 28, 2021 11:54 am

I'm just enjoying the concept of the wheels of capitalism being greased by the blood of the wealthy for once.

Yeah, but plenty of wealthy people are loving the pain felt by short sellers. Like, every CEO of a publicly traded company.

Re: Investment advice

Posted: Thu Jan 28, 2021 12:36 pm

by wlu_lax6

If you enjoy reading this type of thing. Look at Herbalife versus Bill Ackerman. That was a 5 year battle of a guy going short because he thought it was a pyramid scheme. I lost track of the story, but he was super vocal and aggressive. I think it was close to a $1B loss for Ackerman (who went opposite Carl Ichan on this company).

https://seekingalpha.com/article/439407 ... balife-bet

Re: Investment advice

Posted: Thu Jan 28, 2021 12:42 pm

by brian

A_B wrote: ↑Thu Jan 28, 2021 11:11 am

Also, when selling on margin, don't you have to have an account set up to cover at least some (if not all, I can't remember the exact working of margin trading accounts) of the potential losses if the short sell doesn't work they way you were betting? I don't think most day traders have the liquidity to really do a bunch of short selling that would affect the market.

This is essentially the plot of the second half of Trading Places (1980).

Re: Investment advice

Posted: Thu Jan 28, 2021 12:44 pm

by tennbengal

Re: Investment advice

Posted: Thu Jan 28, 2021 1:05 pm

by tennbengal

Shot...

Chaser...

Re: Investment advice

Posted: Thu Jan 28, 2021 1:11 pm

by P.D.X.

That's the stuff right there.

Re: Investment advice

Posted: Thu Jan 28, 2021 1:14 pm

by tennbengal

P.D.X. wrote: ↑Thu Jan 28, 2021 1:11 pm

That's the stuff right there.

Pure. Uncut.