Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

Moderators: Shirley, Sabo, brian, rass, DaveInSeattle

- howard test2

- Jackie Treehorn

- Posts: 84

- Joined: Sun Mar 10, 2013 11:47 pm

Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

Just to remind you, homies. There is no economic recovery. Just some temporary window dressing from printing a couple trillion dollars.

A likely path to the unraveling of the façade, and the exposure of the true bankrupt character of the banking system is an external triggering event. War in Asia (NK, or India/Paki, or even in the Levant, like Syria/Hezballah/Lebanon/Israel). Social or financial unrest in China. Collapse of Japan's currency. Or, of course, something in Europe.

Like the banks in Cyprus snatching between 6.7% and 10% of the depositors' cash. To pay for a bailout/pay off bonds held by EU banks.

Cyprus bailout: Man threatens bank with bulldozer

This is fucking important. Trust me. Even if nothing major happens as an immediate response. (Especially if nothing major happens.) Because, if the people of Europe respond with a 'ho-hum', they will do this same shit to bank depositors in Ireland and maybe even Italy.

The logical response, for anyone who thought their money is safe in a bank in the Eurozone, is to go to the bank Monday morning and withdraw most or all of their money. Particularly if you live in Spain or Italy. Who knows if people will behave according to this logic.

It is difficult for me to fathom such a reckless confiscation of € 5.7 billion without horrific immediate effects. But, so many completely outrageous actions by governments have occurred in the past five years, I've learned that a big "ho-hum" is possible. Maybe even likely.

But i think otherwise. I am guessing some immediate effects. People in Cyprus will withdraw enough from their accounts to ruin those banks right away, and send the message to millions of other European people to do the same. Then, who knows? If I am wrong, and this is a big nothing, I guarantee the big 'they' will do the exact same maneuver, confiscation of a portion of depositor money, on a larger scale in another nation. Who could blame them?

A likely path to the unraveling of the façade, and the exposure of the true bankrupt character of the banking system is an external triggering event. War in Asia (NK, or India/Paki, or even in the Levant, like Syria/Hezballah/Lebanon/Israel). Social or financial unrest in China. Collapse of Japan's currency. Or, of course, something in Europe.

Like the banks in Cyprus snatching between 6.7% and 10% of the depositors' cash. To pay for a bailout/pay off bonds held by EU banks.

Cyprus bailout: Man threatens bank with bulldozer

This is fucking important. Trust me. Even if nothing major happens as an immediate response. (Especially if nothing major happens.) Because, if the people of Europe respond with a 'ho-hum', they will do this same shit to bank depositors in Ireland and maybe even Italy.

The logical response, for anyone who thought their money is safe in a bank in the Eurozone, is to go to the bank Monday morning and withdraw most or all of their money. Particularly if you live in Spain or Italy. Who knows if people will behave according to this logic.

It is difficult for me to fathom such a reckless confiscation of € 5.7 billion without horrific immediate effects. But, so many completely outrageous actions by governments have occurred in the past five years, I've learned that a big "ho-hum" is possible. Maybe even likely.

But i think otherwise. I am guessing some immediate effects. People in Cyprus will withdraw enough from their accounts to ruin those banks right away, and send the message to millions of other European people to do the same. Then, who knows? If I am wrong, and this is a big nothing, I guarantee the big 'they' will do the exact same maneuver, confiscation of a portion of depositor money, on a larger scale in another nation. Who could blame them?

"…and, you ground into a World Series ending double play"

- howard test2

- Jackie Treehorn

- Posts: 84

- Joined: Sun Mar 10, 2013 11:47 pm

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

Here is a good summary of what-ifs.

After Cyprus, eurozone risks transmission failure and running out of road

After Cyprus, eurozone risks transmission failure and running out of road

"…and, you ground into a World Series ending double play"

- howard test2

- Jackie Treehorn

- Posts: 84

- Joined: Sun Mar 10, 2013 11:47 pm

Don't believe me? This guy explains it all

These still crack me the fuck up

"…and, you ground into a World Series ending double play"

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

Great, against the mythological grain essay:

Warren Buffett: Baptist and Bootlegger

How America’s favorite billionaire plays politics to make money

I like and respect Buffet tremendously. But I have been crystal clear for a long time there is a lot more than the 'aw shucks' image he very carefully projects. I don't begrudge him a dime. I hate the game, not this hall of fame playa.

Warren Buffett: Baptist and Bootlegger

How America’s favorite billionaire plays politics to make money

I like and respect Buffet tremendously. But I have been crystal clear for a long time there is a lot more than the 'aw shucks' image he very carefully projects. I don't begrudge him a dime. I hate the game, not this hall of fame playa.

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

Bugmenot doesn't have a working login for that site.

Pack a vest for your james in the city of intercourse

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

Should be free/no login to read that.

And the first bugmenot listed seems to work to login. Or are you smoking that stuff again?

Username h774237@rtrtr.com

Password 1tommyzz

Other

Stats 78% success rate (9 votes)

And the first bugmenot listed seems to work to login. Or are you smoking that stuff again?

Username h774237@rtrtr.com

Password 1tommyzz

Other

Stats 78% success rate (9 votes)

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

The transfer of assets from us to them

You interested in something really important to the future of this country? Peep this:

Philadelphia, 5th Largest City in US is Effectively Bankrupt; Mayor Holds Closed Meeting With Wall Street to Discuss Asset Sales

Philadelphia Bars Public From Mayor’s Investor Meeting

The concentration of wealth in the hands of the few continues apace. Cities and states across the nation own trillions of dollars worth of assets; airports, stadiums, utilities, parks, building of all sorts, parking rights. Wall Street will buy everything they can, for pennies on the dollar, taking a commission along the way.

But nobody talks about this. Few politicians even understand this. You've been given a heads-up.

Philadelphia, 5th Largest City in US is Effectively Bankrupt; Mayor Holds Closed Meeting With Wall Street to Discuss Asset Sales

Philadelphia Bars Public From Mayor’s Investor Meeting

The concentration of wealth in the hands of the few continues apace. Cities and states across the nation own trillions of dollars worth of assets; airports, stadiums, utilities, parks, building of all sorts, parking rights. Wall Street will buy everything they can, for pennies on the dollar, taking a commission along the way.

But nobody talks about this. Few politicians even understand this. You've been given a heads-up.

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

If gold falls any more, I'm gonna have mine bronzed

A quick few words about the stunning crash in the price of gold.

It is really something to see the value of one of your primary assets fall 10% in 90 minutes or so. Builds character or something.

Several months ago, Rerun said he thought the price of gold was in a bubble. I disagreed, but conceded that his view was certainly a possibility. This could be another Romney call; we'll know soon enough.

Here is what I think now. There are two (well, three) kinds of gold 'assets'. The actual physical shiny yellow stuff. The paper assets which are derived from the actual stuff. Futures contracts on many different markets, currency swaps based in part on gold, exchange traded funds, other more esoteric instruments traded off-exchange amongst the hedge funds. (The third kind--stock in companies that actually mine gold. A special, tangible 'futures' contract.)

I understand much better now than I did several months ago that there was and is a definite bubble in the paper assets that represent gold, but are paper. The actual physical stuff, maybe a bubble, maybe not. Remains to be seen.

The price of physical gold and the price of paper representations have been in lockstep. This may or may not continue.

If all prices are in a speculative bubble, when the bubble bursts, they will all collapse. However, if the price of physical gold begins to diverge, to separate from the price of a paper representation of gold, then things will get weird and dangerous.

I have long been convinced there is a big difference between owning a paper gold asset, and owning actual bullion (held in a safe place, by a bank with decades of a secure reputation). I had not thought about how the difference would manifest. I think that may be happening now.

Eventually, one will go down while the other goes up, imo. But along the way, weird wild swings are likely.

n.b. The housing/mortgage markets had some similarities. Real life tangible assets (houses) and a ton of paper claims on those underlying real things piled on top. A lot of similarities. And they fell together; house prices fell while paper assets fell. Different proportional drops, but same direction. There are a number of differences between those markets and the gold situation that lead me to think they will ultimately diverge. But I am aware that an analogous repeat of that history is possible.

It is really something to see the value of one of your primary assets fall 10% in 90 minutes or so. Builds character or something.

Several months ago, Rerun said he thought the price of gold was in a bubble. I disagreed, but conceded that his view was certainly a possibility. This could be another Romney call; we'll know soon enough.

Here is what I think now. There are two (well, three) kinds of gold 'assets'. The actual physical shiny yellow stuff. The paper assets which are derived from the actual stuff. Futures contracts on many different markets, currency swaps based in part on gold, exchange traded funds, other more esoteric instruments traded off-exchange amongst the hedge funds. (The third kind--stock in companies that actually mine gold. A special, tangible 'futures' contract.)

I understand much better now than I did several months ago that there was and is a definite bubble in the paper assets that represent gold, but are paper. The actual physical stuff, maybe a bubble, maybe not. Remains to be seen.

The price of physical gold and the price of paper representations have been in lockstep. This may or may not continue.

If all prices are in a speculative bubble, when the bubble bursts, they will all collapse. However, if the price of physical gold begins to diverge, to separate from the price of a paper representation of gold, then things will get weird and dangerous.

I have long been convinced there is a big difference between owning a paper gold asset, and owning actual bullion (held in a safe place, by a bank with decades of a secure reputation). I had not thought about how the difference would manifest. I think that may be happening now.

Eventually, one will go down while the other goes up, imo. But along the way, weird wild swings are likely.

n.b. The housing/mortgage markets had some similarities. Real life tangible assets (houses) and a ton of paper claims on those underlying real things piled on top. A lot of similarities. And they fell together; house prices fell while paper assets fell. Different proportional drops, but same direction. There are a number of differences between those markets and the gold situation that lead me to think they will ultimately diverge. But I am aware that an analogous repeat of that history is possible.

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

How would they diverge? A lack of trust that there's actually real gold backing the paper?

(in fairness on my call, it was probably 18 months ago. You were right for a long time.)

(in fairness on my call, it was probably 18 months ago. You were right for a long time.)

Totally Kafkaesque

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

You got it, mang. Rather, that is why they would decouple. The 'how' is the issue, I am guessing.Shirley wrote:A lack of trust that there's actually real gold backing the paper?

One side--it is not necessarily an absolute lack of real gold backing, but relative. Leverage. Borrowing to create/finance such paper. Like in the housing market; the houses existed; the mortgages existed. But the second, third and fourth order derivatives on top of those assets were leveraged. The value of the houses didn't fall to zero; they just fell a small percentage, but enough to drop the value of a leveraged derivative to zero. And the subsequent cascade effects.

On top of that, the other side. There is plenty of evidence to cast doubt upon the absolute lack of real gold backing some classes of paper. Maybe just rumor and excuse mongering; maybe not.

The gold and other commodity markets are not for pussies. This shit is dangerous and complex. I don't play there; for me it is nothing more than an alternative currency to hold wealth. This was never about speculation or investment for me, despite occasional boasts which are tongue-in-cheek. Just a personal hedge against bank collapse, with the lucky side effect of a nice hedge against the inflation/dollar devaluation of the last three years or so.

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

-

devilfluff

- Brandt

- Posts: 471

- Joined: Thu Mar 14, 2013 3:41 pm

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

When buying paper gold, the certificates come in 2 types. The first certificate designates a specific amount of gold in a specific place that you own and the certificate company stores. You can go and get your specific gold. The second style is buying a stake in a larger pool of gold. You can go get the amount you own,but it isn't a particular piece. They theoretically distribute the gold first come, first serve. It is possible to oversell the second type, causing later withdrawals to be unavailable.

There's your divergence

There's your divergence

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

Exactly right.

There are other paper assets related to gold, in addition to those devilfluff described nicely. Exchange-traded funds, like ticker symbol GLD (SPDR Gold Trust), are held and traded in huge numbers. The GLD fund as an example, has billions of gold in their possession, additional paper claims to gold, strong audit procedures, and the well-earned trust and confidence of the marketplace. Whether or not they are vulnerable to a divergence of their price from the direct price of physical gold, or otherwise to a loss of confidence, who knows.

There are lots of other paper representations that are not as rigorous, don't actually possess such huge amounts of physical gold in their vaults, don't have the level of trust and confidence. The interconnectedness of the holdings of all these paper claims is obscured, not openly listed on exchanges.

Fuck, I've scared myself. Sell, Mortimer, Sell!

There are other paper assets related to gold, in addition to those devilfluff described nicely. Exchange-traded funds, like ticker symbol GLD (SPDR Gold Trust), are held and traded in huge numbers. The GLD fund as an example, has billions of gold in their possession, additional paper claims to gold, strong audit procedures, and the well-earned trust and confidence of the marketplace. Whether or not they are vulnerable to a divergence of their price from the direct price of physical gold, or otherwise to a loss of confidence, who knows.

There are lots of other paper representations that are not as rigorous, don't actually possess such huge amounts of physical gold in their vaults, don't have the level of trust and confidence. The interconnectedness of the holdings of all these paper claims is obscured, not openly listed on exchanges.

Fuck, I've scared myself. Sell, Mortimer, Sell!

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

- Steve of phpBB

- The Dude

- Posts: 8505

- Joined: Mon Mar 11, 2013 10:44 am

- Location: Feeling gravity's pull

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

So, in good news, apparently one area of federal defense contracting is being cut back.

In less good news, I found out about it when my friend, an engineer for L3, told me he was just laid off.

In less good news, I found out about it when my friend, an engineer for L3, told me he was just laid off.

And his one problem is he didn’t go to Russia that night because he had extracurricular activities, and they froze to death.

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

L3 is laying off? Damn, that ain't a good sign.

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

A seven minute youtube from a really smart dude (with whom I have significant differences, but when you're right you're right) on Why Economics as a field Sucks (my title). His description doesn't include all of the suck, but a huge chunk of it. Robert Johnson.

" onclick="window.open(this.href);return false;

" onclick="window.open(this.href);return false;

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

Re: I don't remember the name, but

They Do Indeed Ring A Bell

Karl's meds are in perfect balance this morning. A restrained (for him) and cogent (as always from him) summary of how we are hearing the third chorus of the same old song.

Karl's meds are in perfect balance this morning. A restrained (for him) and cogent (as always from him) summary of how we are hearing the third chorus of the same old song.

Complacency is one of the key ingredients of a final blowoff and collapse. We saw and felt this in 2007-8. Folks here in the swamp grew tired of my postings about how bad things were getting in March when Bear blew up; in June-July when Freddie Mac blew up; in August when the credit markets were tightening and the chief of Lehman Brothers went on TV defiantly. Of course, all the warnings from us naysayers were forgotten when shit fucking collapsed.

And again, complacency partially fueled by hearing warnings over and over gets stronger again. I feel it in myself. Doubting my own eyes and mind because my conclusions which I figure should be obvious to anyone with a brain are so widely rejected and ignored.

I am in awe at how the 'they' managed to patch it all together in 2009, and build this fake edifice on a foundation of printed up trillions of dollars and euros, and blatant disregard for law and justice. Profiting themselves and their lackeys (with votes and high office) every step of the way. I never would've believed it possible had I not seen it with my own eyes. Truly awesome.

Too bad it is flat out impossible for this fragile economy based on free printed money and illegality to last. My awe will be surpassed by the awe and wonder of what is to come, be it in a month, a year or five years. As soon as I hear just one logical, rational description of how the failure of the façade could possibly be avoided, a description that does not include magical thinking or fantasy, I will consider changing my mind. Just one. Cause all the king's horses and men have yet to offer one.

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

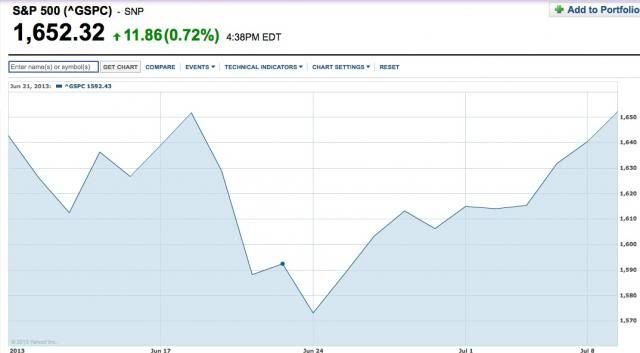

Hey, howard, you haven't been short the market through all this upswing, have you? Here's an excerpt from an e-mail I received today from an NYSE trader.

The S&P has risen 146% from its 12 year low in 2009. But the records don’t just stop with the indexes. Factset put out a report this past week that said more than half the stocks on the S&P 500 touched new 52-week highs, with 141 of those occurring on Friday alone. Another 128 companies reached new 52-week highs earlier in the week. On Wednesday of last week, 538 stocks on the NYSE reached 52-week highs, the largest number since Nov. 2, 2010. The VIX or fear index is in the 12 range (12.89), the lowest since April. And if optimism wasn’t high enough, even some of the highest short interest stocks are outperforming the S&P 500. It’s all good right? It certainly seems so as traders, faced with any type of pull back, look at it as an opportunity to get back into stocks that they might have missed out on. They might get their opportunity as I am reminded by an analyst that the last time the market had a similar amount of stocks reaching a 52 week high in one day, the market pulled back by 4.5%. So the question remains for traders today in a quiet relatively slow market, are stocks overvalued or overbought at the moment, and can they maintain their levels if the Fed begins to taper back the stimulus sooner than expected. We shall see.

"What a bunch of pedantic pricks." - sybian

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

Oh. Hellz. No.

I made a long call on the swamp a few months ago, Feb or March. I can't find it, I don't remember which version of the swamp. But the Fed is 1) printing $85 billion a month and placing in the accounts of the primary dealers; 2) placing an additional $40 billion a month in the form of bond expirations/redemptions in the same place. That is a fuckload of liquidity. That is the reason the equity market is zooming straight up. That is the reason the bond market inches ever higher, and interest rates remain low.

I admit I am surprised that oil and food commodities are not soaring. I am chagrined that gold has fallen during this same period, but the only rational explanations for this (manipulation or a fuckload of deflationary pressure, or both). But gold dynamics are a much much bigger problem for the ben bernack than for me (if it is manipulation, what is going to happen when the manipulation ends, because you cannot continue it indefinitely; if it is deflation, you can print all you want, you are gonna lose.)

This first quarter and a half of 2013 is really one for the history books. If I was smart, I would be riding the wave. But I don't have any free cash (had to throw down on this new business, and my income has dropped significantly), and I have played far far less than I have yammered over the last five years. I dabbled in a couple short-term shorts back between turkey day and xmas, but lost like $100--a weekend in Atlantic City. Not short this year, nor am I long. I assumed gold would rise with the S+P as it has over the past five years--they got me there. But that is long-term hold, like retirement hold.

If gold is a true bubble, I'll get burnt. But I remain confident if gold falls severely (below 1000, to pick a price at random), we'll be in a flat-out depression, worse than the 30s, and I'll be able to buy a good used automobile for a couple ounces of gold. If it is a bubble, and it bursts, I will suck it.

I'll repeat this one more time with feeling--if you think the soaring Dow and S+P are rational indicators for the health of the economy, or evidence of a recovering economy, you are flat-out wrong. Just like those folks were wrong in 1999-2000, and in 2007. The stock market and the true economy have zero to do with one another.

I made a long call on the swamp a few months ago, Feb or March. I can't find it, I don't remember which version of the swamp. But the Fed is 1) printing $85 billion a month and placing in the accounts of the primary dealers; 2) placing an additional $40 billion a month in the form of bond expirations/redemptions in the same place. That is a fuckload of liquidity. That is the reason the equity market is zooming straight up. That is the reason the bond market inches ever higher, and interest rates remain low.

I admit I am surprised that oil and food commodities are not soaring. I am chagrined that gold has fallen during this same period, but the only rational explanations for this (manipulation or a fuckload of deflationary pressure, or both). But gold dynamics are a much much bigger problem for the ben bernack than for me (if it is manipulation, what is going to happen when the manipulation ends, because you cannot continue it indefinitely; if it is deflation, you can print all you want, you are gonna lose.)

This first quarter and a half of 2013 is really one for the history books. If I was smart, I would be riding the wave. But I don't have any free cash (had to throw down on this new business, and my income has dropped significantly), and I have played far far less than I have yammered over the last five years. I dabbled in a couple short-term shorts back between turkey day and xmas, but lost like $100--a weekend in Atlantic City. Not short this year, nor am I long. I assumed gold would rise with the S+P as it has over the past five years--they got me there. But that is long-term hold, like retirement hold.

If gold is a true bubble, I'll get burnt. But I remain confident if gold falls severely (below 1000, to pick a price at random), we'll be in a flat-out depression, worse than the 30s, and I'll be able to buy a good used automobile for a couple ounces of gold. If it is a bubble, and it bursts, I will suck it.

I'll repeat this one more time with feeling--if you think the soaring Dow and S+P are rational indicators for the health of the economy, or evidence of a recovering economy, you are flat-out wrong. Just like those folks were wrong in 1999-2000, and in 2007. The stock market and the true economy have zero to do with one another.

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

I agree with the last sentence, but I do think economic activity is increasing. The data would seem to indicate so.howard wrote:I'll repeat this one more time with feeling--if you think the soaring Dow and S+P are rational indicators for the health of the economy, or evidence of a recovering economy, you are flat-out wrong. Just like those folks were wrong in 1999-2000, and in 2007. The stock market and the true economy have zero to do with one another.

"What a bunch of pedantic pricks." - sybian

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

I agree. A tepid increase, but up is up.sancarlos wrote:…I do think economic activity is increasing. The data would seem to indicate so.

Maybe even starting to reverse. Far less than you would think $2 trillion would buy you. But the data does show little bumps.

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

Hey Howard -- I have an investing opportunity for you. Sounds like you might want to buy what this guy is selling. (Actually, no joke.)

Bandwagon fan of the 2023 STANLEY CUP CHAMPIONS!

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

Not a bad idea. There are easy ways to bet on a crash without paying this middle man.

When Ben stops printing, I'll start shorting. If it crashes before he stops printing, I'll miss it, and I am cool with that.

ETA: since the tread is bumped, here is a link to a blog post posted today on ben's printing. The post itself is OK, a little obtuse. But the comments thread is wonderful--some really smart people with their best guesses on the future. Particularly posters Jake Chase and Richard Kline. Excellent discussion, at least through 30 comments.

The Fed Has Painted Itself in a Corner

When Ben stops printing, I'll start shorting. If it crashes before he stops printing, I'll miss it, and I am cool with that.

ETA: since the tread is bumped, here is a link to a blog post posted today on ben's printing. The post itself is OK, a little obtuse. But the comments thread is wonderful--some really smart people with their best guesses on the future. Particularly posters Jake Chase and Richard Kline. Excellent discussion, at least through 30 comments.

The Fed Has Painted Itself in a Corner

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

The Economy is Just Resting (Soon to go to a nice farm)

Sorry, but this post is off-topic. It has nothing to do with the economy. This is a post on the Stock Market.

A bad couple of days for the Dow, S+P, et al. All the experts are attributing this to The Fed and The Ben Bernack talking about decreasing the amount of free money they routinely print up and hand to the big primary dealer banks on Wall Street.

Surprise, they are wrong. The reason for the selloff is China. Perhaps I should say Supplies!

In 2008, when the world was ending, the Chinese central bank did the same thing as the other big central banks; they printed money and handed it out. They did this on a much bigger scale than did the US or Europe (but the US caught up).

The Chinese central bankers recognized they could not do this forever (if you do, you inflate your currency out of existence.) So, they 'tapered'. Their banking system had grown dependent on this free printed money. When it was withdrawn, their banking system got sick. (There are other reasons the Chinese central bank tightened liquidity as harshly as they have this year; I am giving them the benefit of the doubt, listing the wisest, most logical reason here.)

The Chinese banking system seized up over the past two weeks. Their interbank lending rates (their LIBOR, or Prime rate) skyrocketed; banks and many other financial entities in China became desperate for cash (kinda like the summer of 2008 here, before Lehman Brothers).

Desperate for cash, they start selling what they could, to raise cash. A lot of what they could sell, things they had bought on the international (to their perspective) markets. American stocks. American corporate bonds. American treasury bonds. Gold. Oil futures/options.

The Chinese banks and financial entities own a lot of this shit. When they sold, that accounted for the fall of prices of all these things over the last few days, most notably yesterday.

So, early this morning, The Peoples Bank of China blinked. They printed up a bunch of that yang money, handed it out. Yes, I know, shocking that a powerful central bank would behave in such a manner ("I learned it by watching you, The Ben Bernack!) But, the panic selling by the Chinese financial firms has stopped (for now). American markets have stabilized this morning.

I anticipate a rip-your-face-off rally in the Dow and S+P. With the thirst for liquidity in China sated, and Ben pouring more liquidity into the furnace here, no reason not to see shit resume their rise, and the end game collapse pushed forward into the future yet again.

I'm talking short term here. Couple of weeks. Of course, as I type this, the markets are turning red. Maybe the end is finally here. I'm not hedging, just reinforcing the fact that no one fucking knows when the end of this money printing shit will come, least of all me. This is simple fact. I'm saying I don't think it is right now.

This is all of little relevance anyway. This is just the markets. The real economy remains as fucked as ever. Just look at the paucity of jobs, and the horrific quality of most of the new jobs created in the wonderful recovery--part-time, minimum wage WalMart greeter jobs. Recovery never happened--stock market prices are artificial and 100% dependent upon the money printing game. That reality remains unchanged.

A bad couple of days for the Dow, S+P, et al. All the experts are attributing this to The Fed and The Ben Bernack talking about decreasing the amount of free money they routinely print up and hand to the big primary dealer banks on Wall Street.

Surprise, they are wrong. The reason for the selloff is China. Perhaps I should say Supplies!

In 2008, when the world was ending, the Chinese central bank did the same thing as the other big central banks; they printed money and handed it out. They did this on a much bigger scale than did the US or Europe (but the US caught up).

The Chinese central bankers recognized they could not do this forever (if you do, you inflate your currency out of existence.) So, they 'tapered'. Their banking system had grown dependent on this free printed money. When it was withdrawn, their banking system got sick. (There are other reasons the Chinese central bank tightened liquidity as harshly as they have this year; I am giving them the benefit of the doubt, listing the wisest, most logical reason here.)

The Chinese banking system seized up over the past two weeks. Their interbank lending rates (their LIBOR, or Prime rate) skyrocketed; banks and many other financial entities in China became desperate for cash (kinda like the summer of 2008 here, before Lehman Brothers).

Desperate for cash, they start selling what they could, to raise cash. A lot of what they could sell, things they had bought on the international (to their perspective) markets. American stocks. American corporate bonds. American treasury bonds. Gold. Oil futures/options.

The Chinese banks and financial entities own a lot of this shit. When they sold, that accounted for the fall of prices of all these things over the last few days, most notably yesterday.

So, early this morning, The Peoples Bank of China blinked. They printed up a bunch of that yang money, handed it out. Yes, I know, shocking that a powerful central bank would behave in such a manner ("I learned it by watching you, The Ben Bernack!) But, the panic selling by the Chinese financial firms has stopped (for now). American markets have stabilized this morning.

I anticipate a rip-your-face-off rally in the Dow and S+P. With the thirst for liquidity in China sated, and Ben pouring more liquidity into the furnace here, no reason not to see shit resume their rise, and the end game collapse pushed forward into the future yet again.

I'm talking short term here. Couple of weeks. Of course, as I type this, the markets are turning red. Maybe the end is finally here. I'm not hedging, just reinforcing the fact that no one fucking knows when the end of this money printing shit will come, least of all me. This is simple fact. I'm saying I don't think it is right now.

This is all of little relevance anyway. This is just the markets. The real economy remains as fucked as ever. Just look at the paucity of jobs, and the horrific quality of most of the new jobs created in the wonderful recovery--part-time, minimum wage WalMart greeter jobs. Recovery never happened--stock market prices are artificial and 100% dependent upon the money printing game. That reality remains unchanged.

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

Well, the return of liquidity support in China didn't last. This morning (Sunday night our time), China's central bank stopped their liquidity support. China's market sold off; Europe then USA followed in turn. This afternoon, shenanigans here are curbing the losses. Like a tennis match. But at least I've clued y'all into something important (China's central bank) and the straight-line effects. The media might catch on in a few weeks/months/or never.

Here is something else to watch. Interest rates, your early warning:

10-Year Treasury Yield Up 100 Basis Points Since May; What's That Mean for Mortgage Rates and Housing Affordability?

As I type this, Bloomberg TV showed a graphic and a smiling white girl stating the exact opposite of this article (that interest rates actually being paid by people buying houses are going down today; the exact opposite is true). So many lies all the time coming out of the TV.

“The further a society drifts from the truth, the more it will hate those that speak it.”

~George Orwell

(The sourcing for quote is disputed. I don't care, I like it a lot. If he didn't say it, I'll take credit.)

Here is something else to watch. Interest rates, your early warning:

10-Year Treasury Yield Up 100 Basis Points Since May; What's That Mean for Mortgage Rates and Housing Affordability?

As I type this, Bloomberg TV showed a graphic and a smiling white girl stating the exact opposite of this article (that interest rates actually being paid by people buying houses are going down today; the exact opposite is true). So many lies all the time coming out of the TV.

“The further a society drifts from the truth, the more it will hate those that speak it.”

~George Orwell

(The sourcing for quote is disputed. I don't care, I like it a lot. If he didn't say it, I'll take credit.)

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

- DSafetyGuy

- The Dude

- Posts: 8780

- Joined: Mon Mar 18, 2013 12:29 pm

- Location: Behind the high school

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

I look forward to getting my official pre-approval letters for the trip to go look at houses next week. Sigh.

“All I'm sayin' is, he comes near me, I'll put him in the wall.”

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

Where are you looking to buy/move?

My only fear of death is coming back to this b1tch reincarnated

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

You never know. The Fed might try some more bullshit. And it might work (again) (for a short while). Just keep an eye out.DSafetyGuy wrote:I look forward to getting my official pre-approval letters for the trip to go look at houses next week. Sigh.

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

- DSafetyGuy

- The Dude

- Posts: 8780

- Joined: Mon Mar 18, 2013 12:29 pm

- Location: Behind the high school

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

We are finally making the long-speculated move to Syracuse (actually a suburb about 20 minutes away from downtown).Keg wrote:Where are you looking to buy/move?

Short-ish version: My wife was offered and turned down the job she had been chasing on campus (after her third job interview in about three years). She wants to live close, but not too close, to family and not raise our daughter in LA. We both are keeping our current jobs and need to be reasonably close to an airport for work travel. To accomplish those two, we basically made a triangle of Ann Arbor, Cincinnati, and Syracuse. Many of the cities in that area were too close to family (mostly her father) or had no real draw for us. There are actually some other positive factors in Syracuse for us (she has college friends who still live there, I'll have friends visit to catch games, and I'll be on a press pass for probably around half of the football and basketball seasons).

Shortly after this move, however, I could end up moving to a correctional facility since we'll both be working from home.

“All I'm sayin' is, he comes near me, I'll put him in the wall.”

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

I can't wait for your first 24-inch snowfall. Good times.DSafetyGuy wrote:We are finally making the long-speculated move to Syracuse (actually a suburb about 20 minutes away from downtown).Keg wrote:Where are you looking to buy/move?

Short-ish version: My wife was offered and turned down the job she had been chasing on campus (after her third job interview in about three years). She wants to live close, but not too close, to family and not raise our daughter in LA. We both are keeping our current jobs and need to be reasonably close to an airport for work travel. To accomplish those two, we basically made a triangle of Ann Arbor, Cincinnati, and Syracuse. Many of the cities in that area were too close to family (mostly her father) or had no real draw for us. There are actually some other positive factors in Syracuse for us (she has college friends who still live there, I'll have friends visit to catch games, and I'll be on a press pass for probably around half of the football and basketball seasons).

Shortly after this move, however, I could end up moving to a correctional facility since we'll both be working from home.

Bandwagon fan of the 2023 STANLEY CUP CHAMPIONS!

- DSafetyGuy

- The Dude

- Posts: 8780

- Joined: Mon Mar 18, 2013 12:29 pm

- Location: Behind the high school

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

I trust you mean as a homeowner. I've already lived there for four years previously, including a blizzard that dumped 44 inches of snow, including 35 inches in 24 hours.brian wrote:I can't wait for your first 24-inch snowfall. Good times.DSafetyGuy wrote:We are finally making the long-speculated move to Syracuse (actually a suburb about 20 minutes away from downtown).Keg wrote:Where are you looking to buy/move?

Short-ish version: My wife was offered and turned down the job she had been chasing on campus (after her third job interview in about three years). She wants to live close, but not too close, to family and not raise our daughter in LA. We both are keeping our current jobs and need to be reasonably close to an airport for work travel. To accomplish those two, we basically made a triangle of Ann Arbor, Cincinnati, and Syracuse. Many of the cities in that area were too close to family (mostly her father) or had no real draw for us. There are actually some other positive factors in Syracuse for us (she has college friends who still live there, I'll have friends visit to catch games, and I'll be on a press pass for probably around half of the football and basketball seasons).

Shortly after this move, however, I could end up moving to a correctional facility since we'll both be working from home.

“All I'm sayin' is, he comes near me, I'll put him in the wall.”

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

Yeah, I know you grew up with snow. I mean not having had to deal with it for 15-ish years and then having to remove it from your new home. You will become quickly reacquainted I assume. Syracuse usually gets douched with snow every winter. Viva la lake effect.

Bandwagon fan of the 2023 STANLEY CUP CHAMPIONS!

- DSafetyGuy

- The Dude

- Posts: 8780

- Joined: Mon Mar 18, 2013 12:29 pm

- Location: Behind the high school

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

Yep, a move in early October will give us a chance to scratch out a check for a snow removal service. I'll let you know how it's working out when I see you in Vegas in December.brian wrote:Yeah, I know you grew up with snow. I mean not having had to deal with it for 15-ish years and then having to remove it from your new home. You will become quickly reacquainted I assume. Syracuse usually gets douched with snow every winter. Viva la lake effect.

“All I'm sayin' is, he comes near me, I'll put him in the wall.”

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

Holding gold through this collapse ain't for pussies. Yeah, sucks for me, to watch the (dollar-based) value of my most significant store of personal wealth (other than my house in Cali) fall 30%. I even bought a little on the way down. No regrets. Yet.

I don't have much significant personal memory of historical financial market events. Little to speak of older than the past six years. But I do remember the last time gold fell >30%:

No prediction here. Just sayin'. in 2008-2009, it wasn't the only asset class to take a powder. I don't pretend to know what comes next; just sayin' and watchin'.

I don't have much significant personal memory of historical financial market events. Little to speak of older than the past six years. But I do remember the last time gold fell >30%:

No prediction here. Just sayin'. in 2008-2009, it wasn't the only asset class to take a powder. I don't pretend to know what comes next; just sayin' and watchin'.

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

- govmentchedda

- The Dude

- Posts: 12750

- Joined: Mon Mar 11, 2013 4:36 pm

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

The other day, I saw Roubini predicted it to go below $1000 by 2015.

Until everything is less insane, I'm mixing weed with wine.

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

I have no idea, but I sure hope somewhere in the last 3-4 years there is a forecast from him that it'd go to $3k or so. He has missed a few forecasts since his triumphal call in 2008.

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

howard, keep in mind this thought. When was the last time it went up that quickly? You should have sold, and bought some packets of Victory vegatable seed.howard wrote:Holding gold through this collapse ain't for pussies. Yeah, sucks for me, to watch the (dollar-based) value of my most significant store of personal wealth (other than my house in Cali) fall 30%. I even bought a little on the way down. No regrets. Yet.

I don't have much significant personal memory of historical financial market events. Little to speak of older than the past six years. But I do remember the last time gold fell >30%:

No prediction here. Just sayin'. in 2008-2009, it wasn't the only asset class to take a powder. I don't pretend to know what comes next; just sayin' and watchin'.

It's the sixth version of The Swamp. What could possibly go wrong?

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

You got that right. Unfortunately, I'm not that smart; and I'm distracted by shiny metal things.HDO45331 wrote:howard, keep in mind this thought. When was the last time it went up that quickly? You should have sold, and bought some packets of Victory vegatable seed.

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…

-

Slimprofits

- Jackie Treehorn

- Posts: 1

- Joined: Sun Jul 07, 2013 4:01 am

Re: Economic Collapse--The Trainwreck is Now in SuperSlo-Mo

http://www.macrotrends.net/1334/dollar- ... ical-chart" onclick="window.open(this.href);return false;

Gold got ahead of oil, had to correct. Easy to call it a bubble, but that's incorrect. Not every rise in prices is a bubble, there are several characteristics. When oil starts going up again in earnest gold will as well. Don't be fooled by the so-called "shale revolution", the long-term trend is tighter oil supplies, Central Banks hoarding gold and weaker currencies.

Gold got ahead of oil, had to correct. Easy to call it a bubble, but that's incorrect. Not every rise in prices is a bubble, there are several characteristics. When oil starts going up again in earnest gold will as well. Don't be fooled by the so-called "shale revolution", the long-term trend is tighter oil supplies, Central Banks hoarding gold and weaker currencies.

- Attachments

-

- Macrotrends.org_Dollar_Gold_and_Oil_Historical_Chart.png (62.67 KiB) Viewed 4986 times

Re: The Economy is Just Resting (Soon to go to a nice farm)

I'm not sure if 75 s+p points (about 600 dow points) rips your face off. But every now and then, I get it right.howard, on June 21st wrote: I anticipate a rip-your-face-off rally in the Dow and S+P. With the thirst for liquidity in China sated, and Ben pouring more liquidity into the furnace here, no reason not to see shit resume their rise, and the end game collapse pushed forward into the future yet again.

I'm talking short term here. Couple of weeks.

Who knows? Maybe, you were kidnapped, tied up, taken away and held for ransom.

Those days are gone forever

Over a long time ago

Oh yeah…

Those days are gone forever

Over a long time ago

Oh yeah…